Before I embark on this Engineer value post, let me try and explain why I am explaining this information. While it is very possible that I simply didn’t pay attention to these topics in school, I am also of the opinion that the US educational system does a pretty poor job of preparing people for the real world. But instead of going down that rabbit hole – instead, let me focus this advice from an older me to a younger me. These topics are things that I wish I had known as a young Engineer. There are a LOT of things I did not pay attention to that would have set me up better for things down the road. I wish I had had someone explain things to me, so it is my hope that these posts to a younger me may help some other young Engineer in some way. So even though some of this may be known or could be considered to be common sense, my litmus test for what how things are explained will be younger me. If I wouldn’t have known about it 20 years ago then I own it to my younger self to attempt to explain it now.

If you are already in a development or an engineering field, one of the things that comes quite often is messaging regarding money. “Oh you must make a lot”. Recently I was looking through some Quora questions and saw one about things that you should never ask a Software Engineer. One of the first responses was in regards to comments about them making a lot of money. So let’s get that part out of the way. Engineers typically make a lot of money. Done and dusted. But this post is not intended to talk about how much money people might or might not be getting. This post is meant to attempt to show new Engineers how to think in broader terms about their total compensation amount as this is a much better measure to use when thinking about a job than your base salary.

Huh? What are you talking about? I make $50k a year. At least $70k. I dunno, probably around $90 but I am not sure… Oh yeah! I hit that magic 6-figure number and make $101k! Yeah, pause here for a second. That number is valuable in a lot of different ways, but that number does NOT show the full value of how much you are worth to the company that hired you. We need to talk about a bigger number that represents how much you are worth to the company that you work for. In order to really understand what is going on here, let’s use a hypothetical scenario and paycheck. Here we go!

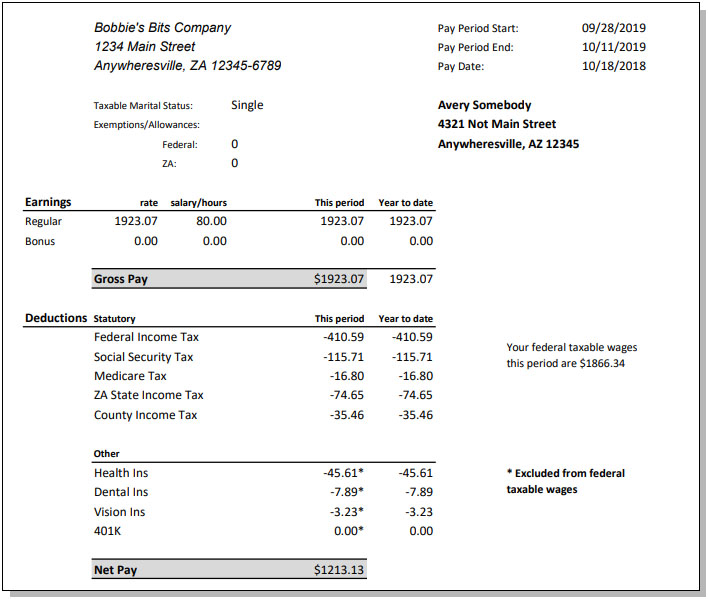

Congratulations you amazing person! You just landed your first full time Engineer gig! And the company is going to pay you $50,000 a year to engineer some stuff! Woohoo! After surviving on ramen and Pabst Blue Ribbon for the past few years in school that hard work has paid off and you are now a working “professional”. After slogging through the first two weeks of paperwork and training and boredom – it is time to check our your first paycheck! Since you are getting paid every 2 weeks for 26 paychecks per year, it is time to start getting ready to getting ready to see that sweet, sweet cheddar for your first installment of $1923.07! (That is $50,000 / 26 pay periods per year, right?) Since you just started and the direct deposit paperwork hasn’t been processed yet you are presented with a hefty envelope that you rip open to see a check for… $1256.92?!? WTF?!?

Ok, lets back up a moment and reset here. First of all – as I just made them up off the top of my head, the numbers above are not real, although they are potentially realistic. I know that I stated that your actual value number would be higher even though the paycheck was nearly 40% lower than what you actually brought home in that 2 weeks. Let’s try and understand why. Before we do that we need to set some assumptions. First, you are single. Second, you live in a very average state (average in terms of state income tax). Third, you only have this one source of income. Fourth, you are young. Great! Now we can talk actual numbers…

In order to try and explain how much you are worth to the company that you are working for we will use the following approximation of a paycheck for reference. However, before we go any further – while these are realistic numbers, they are not real numbers! This post is not intended to be financial advice of any kind! Your numbers will be different! There are a lot of people out there that are smarter than me about money. You should read from and talk to some of them if you want real, actionable advice about your money!

Wow… a lot of numbers. Where should we start? First, if you are anything like I was as a new Engineer then you may be mad at losing 40% of your money, but after getting over that you are just looking at the $1213.13 amount on your check and pretty much ignoring the rest. That is a bad thing. You should try and understand these numbers and how they were reached. Let’s start at the top and work right then down to the Gross Pay line:

- Bobbie’s Bits – The company you work for. Not much to talk about here. Your paycheck may differ and may/may not have this.

- Pay Period Start/End/Pay date – The one thing to note here is when you get paid. In this example you work for two weeks and wait almost a week to get paid for that. 99% of the time this doesn’t matter as long as the paychecks keep coming. However, if you are considering changing jobs or get let go for some reason this is good information to remember! This could help you plan for bridging the gap between one employment and the next.

- Taxable Marital Status & Exemptions – Remember that we made an assumption that you are single. This information reflects taxable withholding. I am not even going to touch this one as I am not an expert here – other than to state that this is set via a W4 form and it is something that you really should review for own situation. This withholding can drastically affect how much is or isn’t held back and can really affect you when filing taxes. There is lots of information on the web and on the IRS site. Look this one up!

- Avery Somebody – This would be you. Not much to talk about here. Your paycheck may differ and may/may not have this.

- Earnings: Rate – Might or might not show up, but I used an example paycheck from the web and it had it. This rate is simply your total salary divided by the number of pay periods. Here that is $50,000 / 26 pay periods per year.

- Earnings: Salary/Hours – As an Engineer you will probably be salaried. More on salaried vs non-salaried positions here in a bit. This just represents the expectation that you have put in a standard 40 hours/week over the 2 weeks of the pay period.

- Earnings: This Period – Here, simply the same as your rate. If for some reason you got overtime or you are being paid hourly then this number would reflect your rate x hours.

- Earnings: Year To Date – Simply a total of how much the company has paid you overall this calendar year. As this represents a first paycheck, it is the same as your earnings for this period.

- Gross Pay – This is basically the raw amount you get before any expenses are taken out. By expenses, I don’t mean rent or mortgage – but instead things like taxes and healthcare. This does represent real money that has been paid to you.

Ok, ok, I get all of that. Now why don’t I get all of that money? How do I go from ~$1920 all the way down to ~$1210?!? Lets take a look at the bottom half of the information. This time, let’s start at the bottom and work our way up.

- Net Pay – This is your take home pay. The sweet, sweet cheddar that let’s you buy a 6-pack of craft beer for the same price as a 30-pack of PBR (Pabst Blue Ribbon). This represents your Gross Pay minus all of the deductions and taxes.

- Other: 401k – I have left 401k out of this example. It is common practice to not start the 401k until 30, 60, or 90 days into the position. Therefore, there is a decent chance that it won’t appear on your first paycheck. The bad news here is that when it does, your Net Pay will take another hit and go down again. The good news is that any money that goes into a 401k is your money and doesn’t seem to just disappear like a lot of the numbers in this section.

- Other: Vision Ins & Other: Dental Ins – You may or may not have these. The company may or may not offer Vision and Dental insurance. But if they do, in my experience they are usually pretty cheap and cover basic stuff. For this example, I made up numbers that are somewhat close to what I have seen in my own experience.

- Other: Health Ins – Again, this may or may not kick in on your first paycheck, but it is one of the bigger expenses and we will discuss more here in a minute. Remember the assumption for you being single? For this example, I took an average cost for a single coverage plan and divided it by 26.

- Excluded from federal taxable wages – This is a very good thing! These expenses come out before your taxes are calculated, thus lowering the amount that you are taxed. Quick numbers here – if you contributed $200/paycheck to a 401k then it would lower your taxable income by that much and you would pay $44 less in taxes. This means that your Net pay would only go down $156 even though you are contributing $200 to your 401k. Nice! (Rough numbers, YMMV (Your Mileage May Vary)!!)

- Statutory: County Income Tax – This one can very wildly depending on where you live. Just know that most municipalities charge taxes for things like local police and fire, county roads, who knows what else. Since this can vary wildly I picked a random value of 1.9% here for this number.

- Statutory: ZA State Income Tax – Taxes for our fictional state of ZA. Like the County tax, this can very wildly based on where you live. Some states have no income taxes, some go up to almost 13%! I tried to pick an average number here and went with 4%.

- Statutory: Medicare Tax & Statutory: Social Security Tax – Together these are known as FICA (the Federal Insurance Contributions Act) and they cover Social Security and Medicare. In most cases you won’t see any return on these for many, many years – but you should understand some basics about each of these. That would take an entire blog post to just scratch the surface as to how these work, so I am just going to recommend that you do some reading on your own here. We will cover how I got to these amounts later, but for now just know that the full FICA tax as of 2019 is 15.3% of your income and your employer is required to pay half.

- Statutory: Federal Income Tax – And now the big one. As of this writing in 2019, the tax bracket for an individual earning $50k/year is 22%. That makes this a simple number to calculate, right? Well for this example I used the simple math, but in reality not so much. Remember the Exemptions item from above? Well here is why you need to pay attention and learn about all of this. For 2019 the tax bracket for a single person like like this: 12% is for people making $9,701 to $39,475. 22% is for people making $39,476 to $84,200. However, in 2019 a single person filing for themselves can take a $12,200 deduction. Ignoring the amounts excluded from federal taxable wages, this standard deduction would drop your initial $50k salary down to a taxable $37,800 and also into a lower tax bracket!!! This would lower your federal income tax from $410.59 to $223.96 and increase your net pay by $186.63 per paycheck!!

- Your federal taxable wages this period are $1866.34 – this is simply your gross pay minus the amounts that are excluded from federal taxable wages. You could think about these as the “good” costs as they do save you some money.

Whew – a lot of numbers and information in that section so let me reiterate: I am not a tax or insurance professional. I have never been one. It has also taken me many, many years to just now get to the point where I am thinking about how to maximize my money in terms of deductions and taxes. The information above is NOT tax advice. It is a cautionary tale to let you know that through a little bit of research and understanding you can potentially save yourself a LOT of money over the long run! Please, please, go do your own reading or find a trustworthy professional and talk to them!

So where does this leave us? Now that we have the paycheck out of the way and a lot of numbers to use, let’s try and understand how much you are worth to your employer. This is an interesting calculation and we need to make a few more assumptions. First, you are fully embedded in the company and are on the company healthcare plan. Second, you are taking full advantage of any 401k matching that is provided. Now we can dive in a little bit and try and add up how much your employer is paying every year for you to be there.

FICA – Social Security & Medicare

As stated above, the total FICA tax per employee is 15.3% of that employees salary. However, your paycheck does not reflect the full 15.3%. For Social Security your employer pays 6.2% and you pay 6.2% for a total of 12.4%. For Medicare, your employer pays 1.45% and you pay 1.45% for a total of 2.9%. Add them up and we hit that 15.3% value. This means that on your $50k salary, your employer will pay an additional $3,825 per year for you to be there.

Health Care

This is another one that can vary pretty wildly. While you may be able to stay on your parents health coverage when just starting out, pretty soon you will be on your own. In your early to mid 20s the discussions about health coverage and having to spend that money may seem boring and like a waste of your time having to sit through that 2 hour lecture when it is benefits time every year. I can 100% promise you that the sooner you pay attention here and invest the time to learn about how all of this works the better off you will be. You WILL use your health insurance. It may be soon or later, but I guarantee that you will use it. Thinking of starting a family? You had better start learning quick! Kids are expensive and go to the doctor – a lot! But that is a side topic. Back to you. You are young. You are single. You are healthy. Based one one estimate I saw that was an average of a number of different plans your single person healthcare will cost approx. $6,896 per year. These numbers can vary and if you throw a spouse and kids in for a family plan that yearly value can shoot up to $15k per year or more! From the single plan number of $6896, on average, your employer pays a big chunk and you are responsible for the remaining $1,186 (divided by 26 is where the $45.61 number came from). Therefore, your employer is paying $5,711 per year for you to have heath insurance.

Retirement

Remember the assumption that you are fully paying into the 401k match? Let’s see how much that costs. I am going to use a total of 4% here. Some companies do 4% outright, others match the first 3% outright then match 1/2% for the next 2 that you put in, others do things in other ways. Retirement accounts are like heath care for your people – you might be thinking about it much. I cannot stress how much you will be helping yourself to spend some time getting this up and running and putting money in early and often here. There are tons of articles and people out there that can help you understand this better. For this example we will assume that the company that you are with matches the first 4% that you put in. Therefore, your employer is paying $2,000 per year into your 401k account for you.

PTO – Paid Time Off

It seems to be a fairly common practice to give entry level Engineers 2 weeks of vacation when starting out. However, PTO is more than just vacation time. If you add up holidays, vacation time, and sick time you will find that you have a certain number of days a year that you get paid for doing nothing. Nice! Let’s use 25 days here. That is 10 vacation days, 8 holidays, and 7 sick days. As there are 260 working days per year (52 weeks x 5 days/week), your daily pay rate is $192.31/day ($50,000 / 260 days). Therefore, your company is paying you $4783 for these days that you aren’t there working.

Other Paid Benefits

Depending on where you work there may be other paid benefits that would factor into these calculations. I am just going to mention 3 of them but there are probably others out there that you may encounter. Life Insurance may be provided and would usually pay out something like 2x or 3x your salary in the case of untimely death while you are working there. This is typically paid for fully by your employer with no cost to you. I found a few numbers here and am going to use a very round $50/month for this benefit. Therefore, your company is paying $600 for your life insurance while you are working there. Long-term disability would cover paying you part of your salary (something like 50-80%) if you experienced disability issues for longer than 90 days (the coverage would start after 90 days). Through some research I found varied numbers but will be using a cost of 3% of salary for this example. Therefore, your company is paying $1500/year or $125/month for you to have long term disability at no cost to you. Similarly, some companies will also offer short-term disability which would be used to cover a percentage of your salary (say 70%) for up to 90 days if you became disabled in some way (at which point long-term disability would kick in). Again, rates vary, but we will use a rate of 3% of your salary here. Therefore, your company is paying $1500/year or $125/month for you to have short term disability at no cost to you.

Summary of Paid Benefits

To sum up all of these costs, for our example, your company is paying the following above and beyond your actual salary:

- $3,825 for FICA (Social Security and Medicare taxes)

- $5,711 for heathcare insurance

- $2,000 into your 401k as a match

- $4783 for PTO

- $600 + $1500 + $1500 for life insurance, long-term disability, and short-term disability

The total for all of this is $19,919. That is 39.8% of your $50,000 salary! We basically just bulls-eyed the 40% estimate that was stated earlier in the post. So I would like to stop and ask you again, how much are you really getting paid?

Now as this is definitely a long post so far I don’t want to dive too deep here but this has not even covered a lot of other paid or unpaid benefits that you may be receiving. Tuition assistance? Parking or toll reimbursement? Professional development? Paid family leave? Flex Spending (FSA) or Health Savings Accounts (HSA)? If you are getting these types of benefits there are direct costs associated with them. What about unpaid benefits? Flex schedules? Working remotely? Work dinners or lunches? Snacks or drinks? How many company-paid cups of coffee did you drink this week? A pet friendly office? Dedicated volunteer hours? While these can be harder to tie a direct cost to, how much are they improving your daily life and fulfillment at work? How much are these types of benefits worth to you?

So at the end of the day, if someone were to ask: How much do you get paid? You can answer with a nice round number, or you can step back and really think about how much money and benefit is being provided to you for spending your time there. It is my hope that this information can help you think about the bigger picture for your job and well being. Thanks for reading!

While researching this post here are some good links with more information:

Comments are closed, but trackbacks and pingbacks are open.